35+ lock mortgage rate before contract

Ad Were Americas 1 Online Lender. Web Typically rate locks are only offered once you have a fully ratified sales contract.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

. The lender will also ask you if you want to lock in the rate or float the rate. If rates go down prior to your loan closing and you want to take advantage of. Web However youll usually have a 45-day window for mortgage shopping.

Lock Your Rate Now With Quicken Loans. If getting a lock. Protect Yourself From a Rise in Rates.

Web A rate lock agreement with your mortgage broker or lender guarantees youll be able to borrow at a specific interest rate provided your home loan or refinance. Web Locking in a mortgage rate protects you against rate hikes that lead to higher monthly payments and long-term costs especially during times of volatility. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

However long term rate locks can be pricey. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

You can choose to lock in your mortgage rate from the moment you select a mortgage up to five days before closing. Web Generally you should lock as soon as you have a signed purchase contract in-hand. Web How to get a mortgage rate lock When your loan is approved your lender may offer a rate lock before submitting the agreement to underwriting.

Web Mortgage interest rates can change daily sometimes hourly. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web When you lock the interest rate youre protected from rate increases due to market conditions.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web For example a borrower who chooses a 30-day lock on a fixed-rate 30-year loan might pay a 4 percent rate and zero points while a 60-day lock might cost 1 point. Web When should you lock in your mortgage rate.

If your lender doesnt offer a rate. This is because rate locks can only be offered for a limited amount of time. If your interest rate is locked your rate wont change between when you get the rate lock and closing.

Web When can I lock in a mortgage interest rate. Web Typically 30 - 60 day locks will cost you nothing. You should lock your mortgage rate as soon as possible in the mortgage process as long as youve already.

They range from 025 - 05 of the loan amount. Theres always a chance rates could rise before closing which may jeopardize.

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Customer Choice Report And Application For Program Fortisbc

Sarah A Colucci York Region S Mortgage Expert Savings Guaranteed Mortgage News

Mortgage Rates Head To 6 10 Year Yield To 4 Yield Curve Fails To Invert And Fed Keeps Hiking Wolf Street

Mortgage Rates Explained A Complete Guide To Get You Up To Speed Fast

What Is A Mortgage Rate Lock Moneytips

Today S Lowest 15 Year Mortgage Rates Chart And Table

:max_bytes(150000):strip_icc()/GettyImages-1035272162-57ccd20680e9470ca01d1ba569982db3.jpg)

Mortgage Rate Lock Definition How It Works Periods And Fees

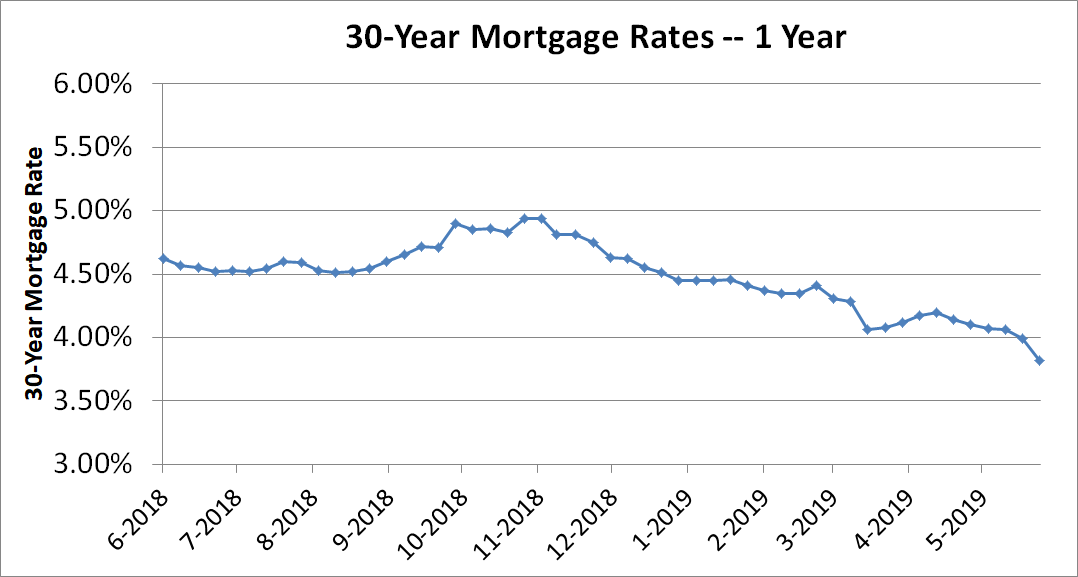

A Foolish Take Plunging Mortgage Rates Could Boost Housing

Mortgage Rate Locks Everything You Need To Know Prevu

Mortgage Rate Lock How And When To Lock In Quicken Loans

When Mortgage Rate Locks Expire Mortgages The New York Times

What Is A Rate Lock Agreement Hauseit Nyc Miami

![]()

Today S 30 Year Mortgage Rates February 2023 Buy Or Refi

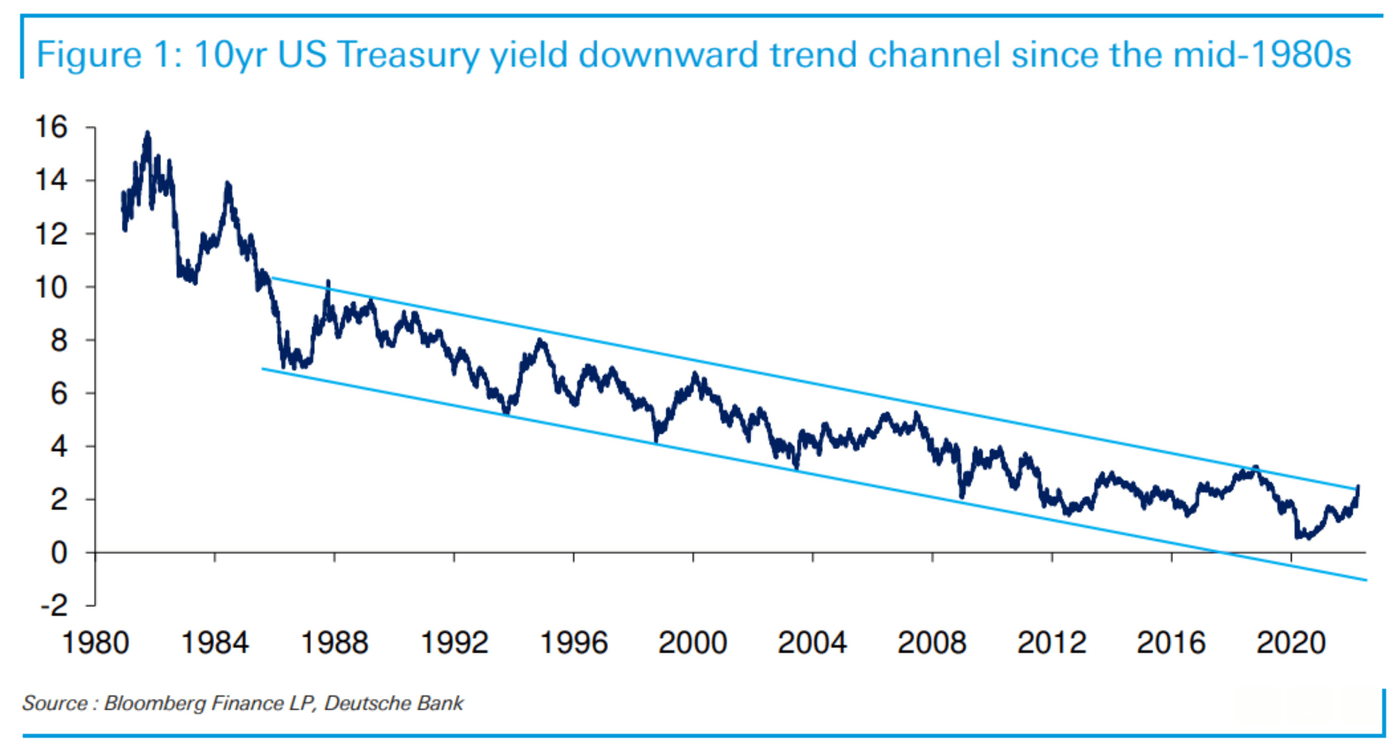

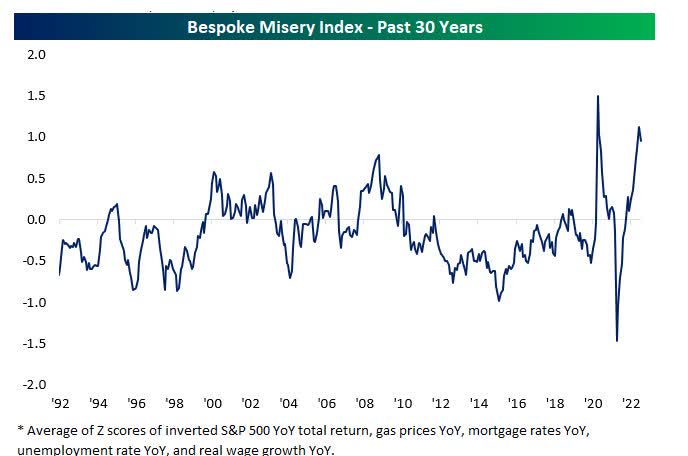

Week On Wall Street A Difficult Uncertain Backdrop Seeking Alpha

I Haven T Signed A Rate Lock Agreement Yet Can I Still Float The Rate Additionally Can I Still Buy Points After A Rate Lock R Personalfinance

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada